March Real Estate Statistics

March reflects strong seller’s market and price increases

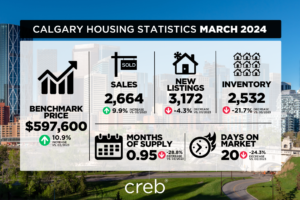

The Calgary Real Estate Board released last months stats, saying March sales rose to 2,664 units, a 10 per cent year-over-year gain and much higher than long-term trends. While new listings did pick up over last month, the 3,172 units were still below what we typically see in March and not enough relative to sales to drive any change in the supply situation. In March, the sales-to-new listings ratio rose to 84 per cent, and the months of supply fell below one month.

“We have not seen March conditions this tight since 2006, which is also the last time we reported high levels of interprovincial migration and a months-of-supply below one month,” said Ann-Marie Lurie, Chief Economist at CREB®. “Moreover, we are entering the third consecutive year of a market favouring the seller as the two-year spike in migration has driven up demand and contributed to the drop in re-sale and rental supply. Given supply adjustments take time, it is not a surprise that we continue to see upward pressure on home prices.”

Inventory levels have declined across properties priced below $1,000,000, with the steepest declines occurring for homes priced below $500,000. In March, there were 2,532 units in inventory, 22 per cent lower than last year and half the levels we traditionally see in March.

In March, the unadjusted total residential benchmark price rose to $597,600, a two per cent gain over last month and nearly 11 per cent higher than last year. Prices have increased across all property types, with the most significant year-over-year gains occurring for the relatively more affordable row and apartment-style homes.

Airdrie

March reported 203 sales and 218 new listings. While both new listings and sales improved, with a sales-to-new listings ratio of 93 per cent, inventory levels were 22 per cent below last year and 56 per cent below typical March levels.

With less than one month of supply, it is not surprising that we continue to see upward pressure on home prices. In March, the benchmark price reached $540,400, a monthly gain of two per cent and a year-over-year increase of over nine per cent. Prices improved across all property types, with stronger year-over-year gains for the relatively lower-priced row and apartment-style products.

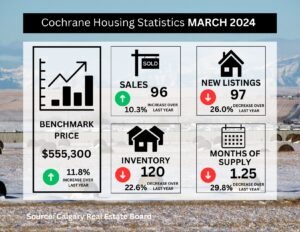

Following a slower start to the year, sales in March rose to nearly the same level of new listings coming onto the market, pushing the sales-to-new listings ratio up to 99 per cent. This also contributed to further declines in inventory levels, and the months of supply dropped to just over one month.

As of March, the total residential benchmark price reached $555,300, a monthly gain of over one per cent and a year-over-year increase of nearly 12 per cent. Prices rose across all property types, and detached prices pushed above $650,000 for the first time.

Okotoks continues to struggle with supply as the 71 new listings that came on the market this month were met with 65 sales, preventing any improvement in inventory levels. There were only 54 units available in March, a year-over-year decline of 10 per cent and nearly 70 per cent below long-term trends for the month.

Limited supply and strong sales caused the months of supply to fall below one month, and March was the lowest March reported since 2006. Persistently tight conditions drove further price growth this month, as the total residential benchmark price rose to $610,700, a monthly gain of one per cent and a year-over-year increase of nine per cent. Prices have been rising for all property types, with the most significant year-over-year gains occurring for semi-detached and row properties.

Read the full release here https://www.creb.com/News/Media_Releases/2024/April/March_reflects_strong_sellers_market_and_price_increases/ and connect with me for more about the hot spring market. Join me on Facebook and Google to be a part of the action!

![]()